The scale and breadth of India's capital markets

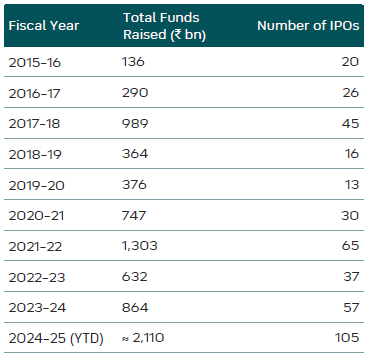

It might surprise many to learn how large and diverse India’s initial public offering (IPO) market has become. Since the onset of Covid-19, the Indian main exchanges have hosted more than 300 main-board IPOs1 raising over $60 billion, according to Prime Database and Business Standard (2025)2. This exceeds the cumulative total raised in the previous two decades3. What stands out today is not just the volume but also the breadth of sectors now coming to market – from financial technology, healthcare and consumer brands to logistics, renewables and professional services. The sheer variety of issuers illustrates the dynamism of India’s private-sector economy and the broadening of its domestic capital markets.

As this IPO boom illustrates (see figure 1 opposite), India’s equity market is maturing rapidly but the other half of the story is the continued development of domestic debt capital markets. Financing the country’s long-term growth ambitions cannot rely on bank balance sheets alone; it will require a much larger role for private and international bond investors in funding infrastructure, corporates and financial institutions. This is one of the reasons we own CRISIL (Credit Rating Information Services of India Limited) in the All-Cap Strategy. As a leading Indian credit-rating agency with strong analytical capabilities and global linkages, CRISIL is a long-term beneficiary of a world in which more Indian borrowers tap bond markets, more investors require independent credit assessment, and transparent pricing of risk becomes a structural feature of India’s growth rather than an afterthought.

Figure 1: The Growth in Indian Public Offerings - 2015 to 2025

Sources: Prime Database (2025); Business Standard (2025); Times of India (2025). Figures represent main-board IPOs only.

Sources: Prime Database (2025); Business Standard (2025); Times of India (2025). Figures represent main-board IPOs only.

A market awash in new listings

An IPO is the moment when a private company enters the public markets. Some list early, some late; some to fund growth, others to provide liquidity for founders or early backers. Whatever the reason, IPOs are milestones but – importantly – they are also moments of marketing. To sell shares to the public, a company must publish extensive disclosures – typically a 300- to 500-page prospectus including business model, risk factors and financial history. Exchanges set differing standards of rigour, but the spirit is the same: to allow potential investors to decide what the business is truly worth.

Selling is not always a red flag

Two-thirds of the capital raised from the recent cohort of IPOs4, however, came not from new shares but from existing shareholders selling down stakes. For a country with such strong long-term growth prospects, that invites an obvious question: why sell? Sales by existing owners are not necessarily negative, of course – founders may have forgone salary while building a business. Generational succession can create opportunities for professional managers. Private-equity funds often require a listing to realise returns or raise new capital. All are normal parts of functioning capital markets. What matters is the timing and motivation of sellers, and whether new shareholders are paying a fair price for sustainable earnings rather than extrapolated growth.

There is value to be found in patience

It is for this reason that we tend to approach new issues with a healthy dose of scepticism. The acronym IPO is sometimes wryly expanded as ‘it’s probably overpriced’, reflecting a long record of deals coming when conditions are most favourable for sellers rather than buyers. The international evidence bears this out. For example, a study5 of 126 Turkish IPOs between 1995 and 2000 finds that, on a buy-and-hold basis, they significantly underperformed the Istanbul Stock Exchange 100 Index over two to five years after listing, with results that echo the broader global literature on long-run IPO underperformance. Similarly in India, a study6 shows that a cohort of 377 main-board IPOs from 2005 to 2015 generated healthy average first-day excess returns of about 22% but then delivered a three-year buy-and-hold abnormal return of roughly minus 57%, with only around 10% of deals beating the market over that period.

There have been, and will continue to be, a few diamonds in the rough, and we expect some of today’s Indian listings to prove very successful franchises over time. However, the current vintage of Indian IPOs appears, in aggregate, to be following historical precedent: strong early enthusiasm followed by more mixed medium-term outcomes as valuations and expectations normalise. For us, this is precisely where opportunity lies.

At Skerryvore, we prefer to think of IPO as ‘investor patience is obligatory’: moments of excitement around new listings are often best approached with discipline, time and a willingness to let high-quality businesses come to us when their prices, governance and track records are more sensibly aligned with long-term returns.

The disconnect between local enthusiasm and global allocation

While domestic investors have eagerly absorbed the recent supply of new equity, foreign investors have been net sellers of Indian equities, pulling more than $20 billion from local markets over the past year as global capital rotated towards Korea, Taiwan and other markets more exposed to the artificial-intelligence (AI) supply chain7. Despite record issuance, therefore, the Indian market has lagged broader emerging-market indices in 2025. This divergence highlights that a vibrant domestic IPO pipeline does not automatically translate into short-term performance for overseas investors. Valuations in several high-profile listings remain rich by global standards, reflecting strong local demand but leaving little margin of safety.

Patience, Valuation and Opportunity

At Skerryvore, we invest for the long term in high-quality emerging-market businesses. While we understand the allure of short-term IPO gains, our experience suggests the balance of probabilities favours patience. After exuberance fades and valuations normalise, businesses that truly create value often re-enter our universe at more attractive prices – sometimes after lock-ups expire or when early investors exit.

This discipline has already led us to find opportunities among India’s post-IPO cohort. Our recent purchase of KFin Technologies, a high-quality provider of registry and fund-administration services, reflects precisely the type of business we look for: aligned management, recurring revenues and a durable competitive position serving India’s expanding savings industry. It may also be representative of the broader opportunity that a more seasoned Indian market will continue to present – strong businesses, at fairer valuations, in an economy whose structural growth story remains intact.

1. Main board IPO’s are those which meet strict Securities Exchange Board of India (SEBI) capital and profitability criteria and are placed on the National Stock exchange (NSE) or Bombay Stock Exchange (BSE)

2. Business Standard (19 December 2025) Amid ₹1.85-trn fund raise, here are 5 lessons from IPO investing in 2025; https://www.business-standard.com/markets/news/amid-1-85-trn-fund-raise-here-are-5-lessons-from-ipo-investing-in-2025-125121900099_1.html

3. The Hindu Businessline (18 November 2025). Indian IPO market raises more in five years than previous two decades. https://www.thehindubusinessline.com/companies/indian-ipo-market-raises-more-in-five-years-than-z/article70293924.ece

4. Fortune India (3rd August 2025) OFS share in IPOs hits 3-year high as promoters cash in on high valuations https://www.fortuneindia.com/markets/ipo/ofs-share-in-ipos-hits-3-year-high-as-promoters-cash-in-on-high-valuations-2/125899

5. Erdoğan, A.I. (2010). The long-run performance of initial public offerings: The case of Turkey. European Journal of Economics, Finance and Administrative Sciences, 26, 57–64.

6. Dhamija, S., & Arora, R.K. (2017). Determinants of long-run performance of initial public offerings: Evidence from India. Vision: The Journal of Business Perspective, 21(1), 35–45

7. Financial Times (3 December 2025) Indian equities underperform peers by widest margin in three decades https://www.ft.com/content/14bf78f6-e414-4bd7-973b-2b42da0bdde2

Any information provided in this document relating to specific companies/securities should not be considered a recommendation to buy or sell any particular company/security.