The business of bottling and distributing beverages in emerging markets has created some high-quality family-owned franchises, with significant pricing power and long runways for growth. They present a possibly underestimated investment opportunity, which is why we currently have around 7% of our clients’ capital invested in publicly listed emerging-market Coca-Cola bottlers – Coca-Cola FEMSA, Coca-Cola HBC (CCH), Arca Continental and Embotelladora Andina. These companies exhibit attributes that we value: family ownership, high levels of alignment, pricing power and resilient growth. At the same time, we believe, their current share prices underestimate their long-term pricing power and ability to compound over time.

Diversified growth

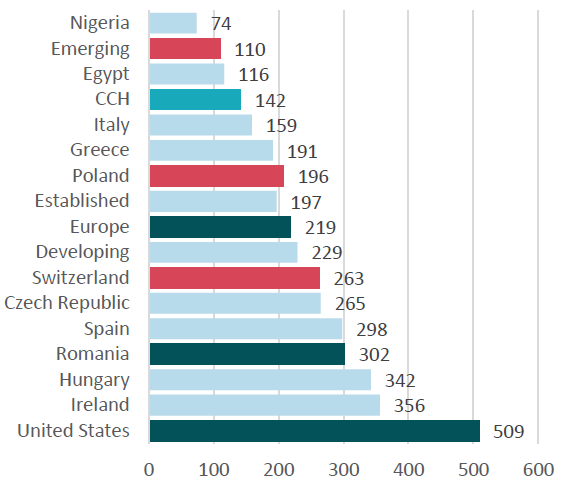

Today, emerging and developing economies account for 80% of the world’s population, yet people in these regions currently buy only about two out of every 10 drinks they consume, compared with seven or eight out of 10 in developed markets1. This indicates a vast, largely untapped market for Coca-Cola and its peers, with substantial room for volume growth as purchasing power and consumption habits evolve. For example, the average Indian consumes just nine eight-ounce (c. 250ml) bottles of Coke annually, compared with a global average of 922. This low base offers substantial headroom for growth as consumers become wealthier and market penetration increases – a dynamic that can be seen in CCH’s diverse geographic footprint (figure 1).

Figure 1. CCH sparkling servings per capita, 2023

Source: CCH Factsheet (November 2024)

Source: CCH Factsheet (November 2024)

The long-term growth opportunity for CCH is a significant one. Per capita consumption of soft drinks in Nigeria remains the lowest out of its 28 territories3 despite it being the founding territory of the group, with the Leventis family establishing the Nigerian Bottling Company in 1951. As incomes rise and modern retail expands, the core product of Coca-Cola should grow for many years. Part of the advantage of these businesses, however, is their partnership with The Coca-Cola Company (TCCC), which develops sophisticated insights into consumers around the world, meaning these emerging-market franchises are not solely dependent on the growth of sparkling beverage consumption, but on a much broader portfolio of drinks that compete not just with sparkling colas but with everything a consumer chooses to drink on any occasion. TCCC has been actively expanding its product portfolio in emerging markets, including the introduction of low- and no-sugar beverages, energy drinks and ready-to-drink juices and teas. This diversification helps the company appeal to a broader range of consumer preferences and adapt to changing health trends, further supporting and de-risking long-term growth.

It is not just product but also geographic diversification that supports these business models and allows them to offset the volatility in any single market. For example, CCH’s exposure to the political and economic vicissitudes of Nigeria is balanced by more stable cash flows from Central and Eastern Europe. Collectively, our holdings across Coca-Cola bottlers represent cash flows from more than 35 different countries, making these quite diversified investments.

Successful partnerships

These business models – and the uniquely symbiotic relationships built over many years between TCCC and its bottlers – embed the principles and benefits of alignment that are central to our investment philosophy. Simply put, TCCC – headquartered in Atlanta – provides the brands and syrup concentrate, while the bottlers produce and deliver the product to the end consumer. This clear and simple division of responsibilities brings benefits to both parties, as can be seen in figure 2.

Figure 2. Benefits of the franchise model to Coca-Cola and its bottlers

This franchise model importantly sets the stage for strong competitive moats at the local level that are allied to more than 30 brands provided by TCCC, which each generate over a billion dollars in revenue globally. Such is the strength of the brand that the term ‘Coca-Cola’ is the world’s second most recognised phrase after ‘OK’4.

The bottlers benefit from this brand strength through consistent pricing power and pervasive consumption habits. This entrenched brand loyalty makes switching to a competitor difficult, especially given the product’s ubiquity (e.g. vending machines, corner stores, restaurants). Over decades, the bottlers have built intimate, hard-to-replicate relationships with local retailers, kiosks, restaurants and supermarkets. These relationships are not just about delivering product. They include help with inventory management, ‘free’ equipment (e.g. coolers, dispensers), credit terms and increasingly deep consumer insights. This intimate customer integration acts as a switching cost, both for retailers and for TCCC. It would be extremely costly and risky for any new entrant, or even TCCC, to replicate these capabilities at a local level, which ensures strong alignment between TCCC and its bottlers.

Aligned owners

The embedded switching costs within this model also drive another differentiated element of the relationship between TCCC and its bottlers – the ownership of minority stakes, where TCCC sits alongside the founders of the bottling company on the shareholder register. Although this is not a universal rule, TCCC holds minority equity stakes in many of its major bottling partners, typically ranging from about 15% to 27%. For example, it holds stakes in CCH (21%), Coca-Cola Europacific Partners (17%) and Coca-Cola FEMSA (27%)5. This ensures TCCC is not incentivised to overcharge its bottlers for concentrate or marketing but benefits from the scale and exclusivity arrangements it provides to bottlers via its share of the profits.

The local monopoly provided to each bottler is important because it enables them to spread fixed costs (plants, trucks, equipment, systems) over a large volume base, lowering per-unit costs and increasing profitability. A new entrant would need very deep pockets to have any chance of competing and, even then, would be unlikely to achieve the returns that accrue to the Coca-Cola system. Aside from investing, managing logistics, production scheduling and product complexity across diverse regions is a skillset that is not easily acquired.

We believe that relative to the broader emerging markets universe, this high level of alignment strongly protects minority investors and is an underappreciated source of resilience. For example, in the case of CCH our clients are strongly aligned both with the Leventis family, which owns 23% of the equity through its Kar-Tess Holding company, and with TCCC, which owns a further 21%.

Pricing power

The first bottling contract was signed for $1 in 1899 with Benjamin Thomas and Joseph Whitehead, who saw the opportunity to bottle Coke from soda fountains to sell the product more broadly. This contract specified a fixed price for concentrate in perpetuity. Quite remarkably for over 70 years (between 1886 and 1959), the price of a 6.5 US fl oz (190ml) bottle of Coca-Cola remained fixed at one nickel6. This approach provided predictability but over time the fixed price couldn’t incentivise volume growth or respond to changes in raw material prices.

During the early 2000s under the direction of TCCC CEO Douglas Daft there was a move to empower the bottlers to ‘think local, act local’ so they could respond more nimbly to competition in each market7. This helped move the model from an adversarial basis to one that recognised the power of partnership, creating a mutual win-win – closer co-operation, in which TCCC would price based on local dynamics, invest alongside the bottlers in developing infrastructure and even acquire strong local brands jointly such as Thumbs Up in India and Inca Kola in Peru.

TCCC’s partnership with most of its key bottlers is key to their local pricing power and revenue management tools. This is because TCCC needed the bottlers to invest in more complicated and varied production methods to produce a price pack architecture (PPA) that offers products in a variety of package sizes, formats and price points to target different consumer segments, occasions and channels. For Coca-Cola bottlers, this means a broad portfolio ranging from mini-cans to large bottles, each with its own pricing logic. The resulting pricing variability per millilitre was identified by a UK consumer watchdog magazine in 2022 and can be clearly seen in figure 3.

Figure 3. Price pack architecture drives differentiated revenue per millilitre

Source: Which? Consumer Reports, 20228

This makes it difficult for consumers to compare prices directly across formats or with competitors, potentially reducing pricing transparency. The result is a low level of pricing visibility compared with, say, the price of a pint of beer that has enabled Coca-Cola bottlers to more nimbly navigate inflation than some other types of beverage businesses we look at.

The high levels of local knowledge and data held by the bottlers allow them to tailor their PPA to specific channels (e.g. convenience stores, supermarkets, restaurants) and consumption occasions, leading to different prices for similar volumes depending on where and how the product is purchased. Using detailed customer relationship management (CRM) databases bottlers can even segment prices and offerings within a city, with larger bottles and lower prices being offered in less wealthy areas, and smaller, more expensive cans and bottles being offered in wealthier areas.

Not without risk

Of course, no investment is risk-free. Bottlers are exposed to risks ranging from changing consumer preferences, volatile commodity input costs and regulatory demands and changes, most notably through sugar taxes and packaging mandates. Growing consumer demand for healthier lifestyles also requires reformulation of products with low or no sugar.

There are also important sustainability risks that must be considered, most notably around water usage, plastic packaging, waste collection and recycling. This is why we believe that assessing sustainability factors is key when considering the long-term financial health of a business. If they are left unattended, over time sustainability risks inevitably become financial or reputational risks.

The Coca-Cola system, however, has proved resilient by diversifying into a broader range of products, reducing water and plastic consumption and investing for the long term in areas such as recycling. All of this is helped by the fact that no competitor can easily replicate Coca-Cola’s scale, brand equity and local distribution networks. Even large global beverage brands face enormous friction trying to copy what the best bottlers have spent decades building, which helps explain why some bottlers are starting to distribute for other FMCG (fast-moving consumer goods) companies, adding low-unit but high-margin revenue.

Global leading governance, Global leading brands

Coca-Cola HBC and Coca-Cola FEMSA are exemplary models of high-quality listed businesses in emerging markets. Through strategic market penetration, operational excellence and a keen understanding of local dynamics, they have established themselves as leaders in the beverage industry.

Although we have yet to find an Asian Coca-Cola franchise we would like to own, we note that TCCC has recently announced a new partnership with a family business in India, where its bottling operations are currently unlisted. Perhaps in the future we will see interesting Asian and African bottling franchises coming to the market.

Coca-Cola bottlers offer a potentially rewarding investment opportunity: steady cash flow, defensible returns on capital and exposure to long-term emerging-market growth, from both increasing population and rising wealth. These are the kinds of businesses we believe are worth holding through cycles – quiet compounders that win through strong alignment and a long-term investment horizon that benefits both customers and shareholders.

1. Food Business News (6 December 2024). Coca-Cola expects growth in emerging markets, fairlife. https://www.foodbusinessnews.net/articles/27315-coca-cola-expects-growth-in-emerging-markets-fairlife

2. World Population Review. Coca Cola Consumption by Country 2025. https://worldpopulationreview.com/country-rankings/coca-cola-consumption-by-country

3. CCH Annual Report, 2024.

4. Business Insider (20 September 2016). 15 mind-blowing facts about Coca-Cola. https://www.businessinsider.com/facts-about-coca-cola-2015-9

5. Skerryvore Analysis: CCH, Coca-Cola Company, CCEP, Coke FEMSA.

6. Levy, D., and Young, A.T. (August 2004). ‘The Real Thing:’ Nominal Price Rigidity of the Nickel Coke, 1886–1959. Journal of Money Credit and Banking, 36(0402013).

6i. Chegg. Case Analysis: Strategic Leadership at Coca-Cola. https://www.chegg.com/homework-help/questions-and-answers/section-case-analysis-case-strategic-leadership-coca-cola-real-thing-coca-cola-trouble-200-q96699828

7. Banutu & Gomez (2012) Coca-Cola: International Business Strategy for Globalisation delivered at the International Trade & Academic Research Conference, 7-8th November, 2012.

8. Which? (August, 2022) https://www.which.co.uk/policy-and-insight/article/paying-the-price-supermarkets-confusing-shoppers-with-unclear-product-pricing-amid-cost-of-living-crisis-which-finds-aWc1h3N0zmwh

Any information provided in this document relating to specific companies/securities should not be considered a recommendation to buy or sell any particular company/security.