Water scarcity - a growing issue

‘Water stress’ describes a situation where the demand for water is greater than the available supply in a particular area, whether because of insufficient quantity or poor quality. According to the World Resources Institute, nearly a quarter of the global population face extreme water stress each year and roughly half the global population face water stress for at least one month per year[1].

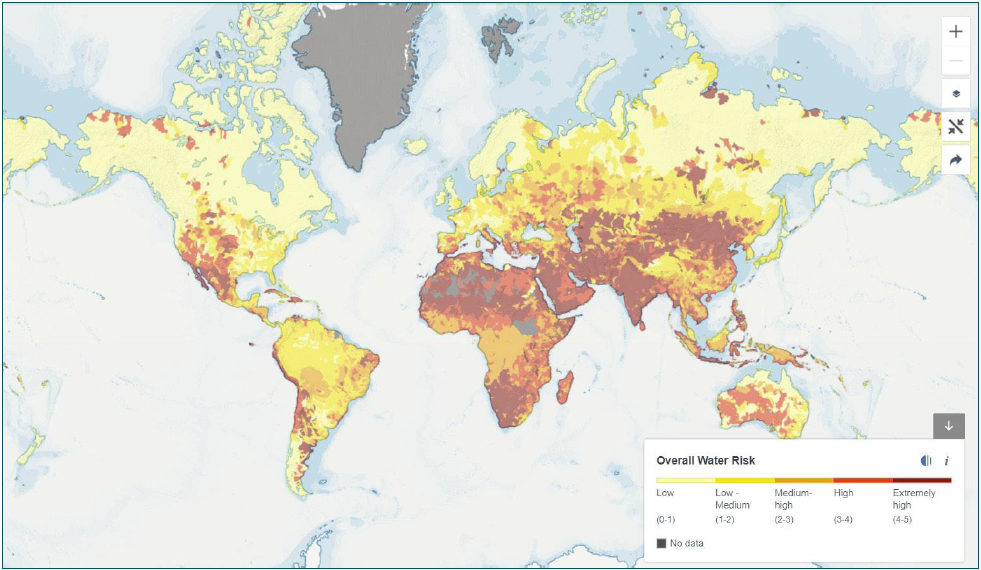

As figure 1 shows, the majority of these countries are emerging markets, making this issue even more important to our investment universe. Water demand is expected to grow by 20–25% globally by 2050 and the number of regions facing water stress is also set to expand. Large economies with young populations – such as India, Mexico and Egypt – face some of the biggest issues.

Figure 1. World Resources Institute, Aqueduct Water Risk Atlas (as of 16 August 2023)[2]

Coca-Cola and its bottling partners recognise the risks associated with water scarcity and are taking steps to mitigate them. This includes investing in innovation and infrastructure solutions, enabling legislation and collaboration with others including industry peers, local governments and civil society.

Coca-Cola's 2035 Water Stewarship goals

Coca-Cola has set two key objectives to improve water resilience by 2035[3].

- Aim to return more than 100% of the water used in finished products globally, on an aggregate level, to nature and communities.

- Seek to return 100% of the total water used in each of the more than 200 high-risk locations across the Coca-Cola system.

Water is essential to people and ecosystems and because it is sourced locally, replenishment or return goals and investment, particularly in areas of high risk or water stress, are crucial. High-risk locations, determined through extensive analysis in 2024, represent almost a third of Coca-Cola system’s locations globally[3].

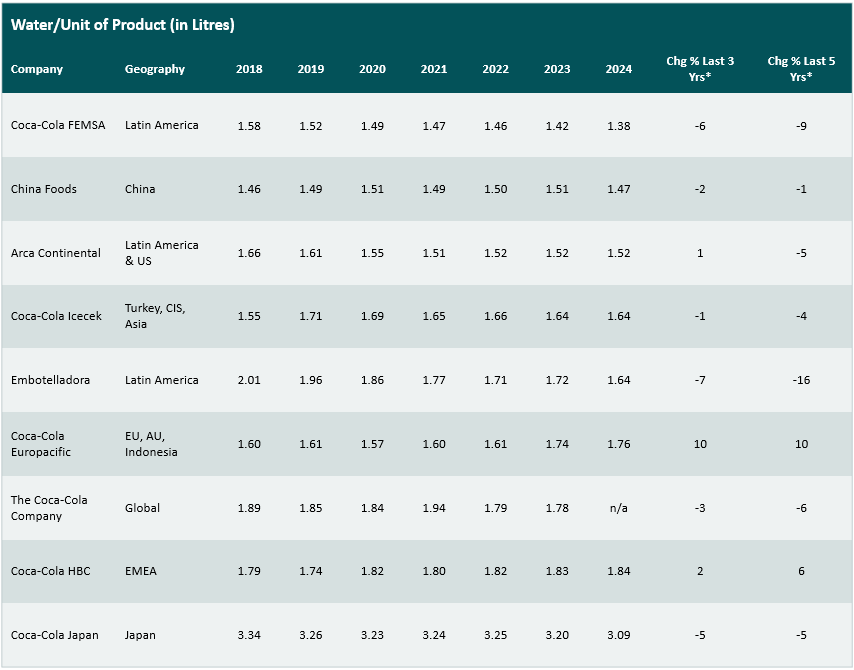

A key metric in this strategy is the water use ratio (WUR), which tracks the number of litres used per litre of beverage produced. Although this is useful for driving best practice and efficiency comparisons (as in table 1 below), it should be noted that WUR does not account for water-intensive packaging production.

Table 1. Water use efficiency comparison within the Coca-Cola system

Source: company and Bloomberg reports. (*Using calendar year end data available as of 30 June 2025)

Bottler-led initiatives

Many Coca-Cola bottlers are leading sustainability projects tailored to local needs – for example:

- Arca Continental: rainwater recovery from school roofs and a wetland project in Baja California[4].

- Andina: watershed restoration at Lake Ypacaraí and agricultural water tracking via satellites[5].

- Coca-Cola HBC: ionised air rinsing technology to save millions of litres[6].

- FEMSA: achieved Alliance for Water Stewardship certification at nine plants. Some Mexican plants now operate at a WUR of 1.20 l/l or better, while Colombia’s Tocancipá plant leads at 1.17 l/l[7].

Additionally, the Coca-Cola bottlers are focusing on agriculture, which accounts for over 70% of global freshwater use[8]. Partnerships with KILIMO and regional farming programmes aim to optimise irrigation and reduce consumption[8].

Bottled water - an additional challenge in Latin America

Latin America – particularly Mexico – consumes a large amount of bottled water. Given concerns over rising water stress, this has created regulatory and reputational risks for bottling companies[9]. Water extraction rights have historically been stable, but events such as the Nuevo León drought in 2022 underscore emerging challenges[10]. With bulk water sales in particular facing increasing scrutiny, diversifying into functional beverages, energy drinks and coffee could reduce reliance on bottled water over time.

Nestlé’s 2021 sale of its North American water business highlights another potential strategy for Coca-Cola and its bottlers[11]. Whether through divestment, innovation or operational shifts, long-term resilience will be key to ensuring sustainable growth in an era of rising water scarcity.

Conclusion

In our valuation work we try to differentiate the severity of this longer-term risk for various bottlers that have more or less exposure to high-water-stress areas. We do this by assessing both the appropriate long-term growth and discount rate applied to future cashflow growth as well as their own volume mix by category.

There is very little visibility on exactly how the challenges of water stress will play out over time, which is an issue not only for us but also for the management team at Coca-Cola and those within the Coca-Cola system. We do, however, seek to identify management teams who are far-sighted and fair-minded in their approach to the analysis and mitigation of such risks and continue to engage actively with the management teams of our holdings on this front. In this case we believe Coca-Cola and its bottlers are looking after the long term by investing in resilience.

1 World Resources Institute (16 August 2023). 25 countries, housing one-quarter of the population, face extremely high water stress. www.wri.org/insights/highest-water-stressed-countries

2 World Resources Institute – Aqueduct Water Risk Atlas. (16 August 2023) https://www.wri.org/applications/aqueduct/water-risk-atlas/#/?advanced and https://www.wri.org/research/aqueduct-40-updated-decision-relevant-global-water-risk-indicators

3 The Coca-Cola Company (February 2024). The Coca-Cola Company evolves voluntary environmental goals. https://www.coca-colacompany.com/media-center/the-coca-cola-company-evolves-voluntary-environmental-goals

4 Arca Continental (8 May 2025). Arca Continental and Fundación Coca-Cola México inaugurate 8 rainwater harvesting systems in Tlaquepaque. www.arcacontal.com/en/noticia/sustainability/arca-continental-and-fundacion-coca-cola-mexico-inaugurate-8-rainwater

Arca Continental (4 December 2024). Arca Continental and Coca-Cola México inaugurate artificial wetland to clean water in Mexicali, Baja California. www.arcacontal.com/en/node/904

5 Coca-Cola Andina. Annual Sustainability Report 2024. https://koandina-prod-files-bucket.s3.amazonaws.com/wp-content/uploads/2025/05/08144221/Memoria-Integrada-2024-ENG.pdf

6 Coca-Cola HBC (May 2021). Water stewardship stakeholder event https://www.nature.org/content/dam/tnc/nature/en/documents/Coca-Cola-Co-Partners-Approach-Addressing-Watershed-Health_March-2024.pdf

7 Mexicobusiness.News (1 April 2025). FEMSA expands water stewardship certification in Latin America. https://mexicobusiness.news/agribusiness/news/femsa-expands-water-stewardship-certification-latin-america

8 Coca-Cola Company (March 2024). The Coca-Cola Company and Partners’ approach to addressing watershed health. https://www.nature.org/content/dam/tnc/nature/en/documents/Coca-Cola-Co-Partners-Approach-Addressing-Watershed-Health_March-2024.pdf

9 The Guardian (28 July 2022). ‘It’s plunder’: Mexico desperate for water while drinks companies use billions of litres. www.theguardian.com/global-development/2022/jul/28/water-is-the-real-thing-but-millions-of-mexicans-are-struggling-without-it

La Jornada (17 September 2023). Mexico, the largest consumer of bottled water in the world. www.jornada.com.mx/notas/2021/04/02/economia/mexico-el-mayor-consumidor-de-agua-embotellada-en-el-mundo

10 Reuters (30 July 2022). Mexico declares drought in northern state of Nuevo Leon matter of ‘national security’. www.reuters.com/world/americas/mexico-declares-drought-northern-state-nuevo-leon-matter-national-security-2022-07-30

11 USA Herald (8 May 2025). Nestlé $5.6B water unit sale amid brand overhaul. https://usaherald.com/nestle-5-6b-water-unit-sale-amid-brand-overhaul